CHAIRMAN'S LETTER TO SHAREHOLDERS

Ronnie C. Chan

ChairmanRESULTS AND DIVIDEND

For the year ended December 31, 2013, turnover increased 22% to HK$9,734 million. Net profit attributable to shareholders decreased 13% to HK$4,557 million as there were fewer disposals of non-core investment properties compared to the year before. Consequently, earnings per share also fell 13% to HK$3.38.

When excluding all effects of revaluation gain, the underlying net profit attributable to shareholders was 14% lower at HK$3,071 million. Underlying earnings per share retreated similarly to HK$2.27.

The Board recommends a final dividend of HK$0.61 per share. If approved by shareholders, total dividends per share for the year ended December 31, 2013 will be HK$0.80, an increase of 1.3% compared to the previous year.

BUSINESS REVIEW

Real estate everywhere, especially the residential segment, is to a good extent affected by government policies. There are many reasons and they are all understandable. Just to name a few: home ownership is a cornerstone to social stability. For most people, a dwelling unit is the biggest investment in his or her life and the mortgage is the greatest debt burden. As a result, home purchase is very significant to most citizens. Whether one owns or rents, housing is a basic necessity of life and the government is expected to ensure its steady supply. In many places such as mainland China and Hong Kong, land supply is controlled by the government. Building construction is a complicated process involving big dollars. Its quality control is critical in the sense that a house should be safe and should last for at least decades. Being a major part of any economy, the knock-on effect of house building is critical to its overall health.

No wonder every government carefully watches our industry, and property companies are very sensitive to government policies. In both mainland China and Hong Kong, the two markets where we play, there is a new administration of late. From what we can tell, they differ from their respective predecessors in one critical respect: they both provide active leadership which means many new policies. Some of them will inevitably affect our industry. In this sense, it is a brave new world that developers must now face.

On the Mainland, I have never seen such serious efforts to curb corruption. And in Hong Kong, the present government is doing its best to reverse years of inaction on the part of the last administration. It strives to supply land on the one hand, and on the other, employs administrative measures to check demand. In both places, such new policies are hurting our business. But since they are the right things to do, we fully support them.

Everywhere we go on the Mainland, anti-corruption and anti-opulence measures targeting civil servants are affecting the sales of certain luxury goods. Previously a good portion – although to be sure not all – of the purchases of high-end products for gifting and expensive services was no doubt related to government officials. These purchases are now seriously curtailed.

Some have asked for my opinion on when these policies will be relaxed. My answer has always been: I hope they never will. As many other parts of the world have shown, economies built upon improper spending such as that relating to corruption cannot last. They are merely sowing the seeds of their own demise. It is much better that a country like China with myriads of legitimate and vibrant economic activities should sooner rather than later rid itself of such cancerous elements. In the long term, the economy will grow more healthily and will generate new demand to replace the shady ones.

Roughly half of our Mainland malls can be considered deluxe. Their retail sales were particularly affected by the policies. Nevertheless, in the face of such an unfavorable environment, we still managed on the Mainland to increase rents by 13% and related operating profit by 12%. When excluding the newer properties of Forum 66 and Center 66, the two numbers still advanced by 5% and 7% respectively.

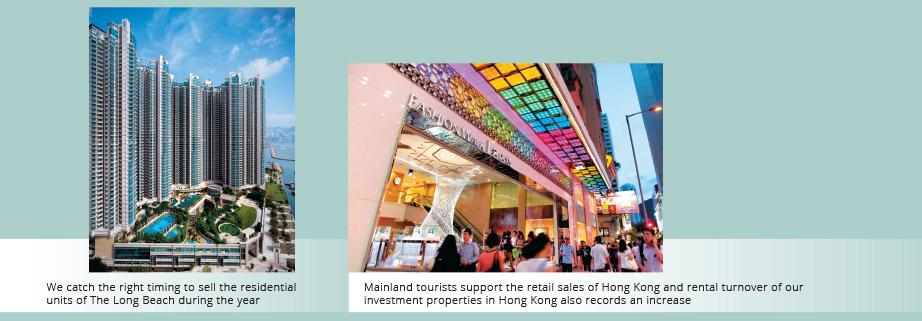

In our home market Hong Kong, the government under Chief Executive Mr C.Y. Leung has introduced rather draconian measures to stall demand. Together with the foreseeable supply of land, residential prices have no place to go but down. As such, we, through our subsidiary Hang Lung Properties, were fortunate to have seized the window of opportunity and sold 272 units at a margin very similar to that of our previous sales.

Our Hong Kong investment properties on the other hand are a beneficiary of the government’s non-real estate-related policies. The continual arrival of Mainland tourists has buoyed retail sales. Our rental turnover and operating profit respectively went up 10% and 11% after removing the effects of the sales of numerous fringe assets the year before. The nominal increases were respectively 1% and 3%. We received 12% more revenue from retail space and 9% from offices. Occupancy rates were respectively 98% and 94% for the two product types. Overall rental margin improved two points to 85% which reflected the effects of the sale of non-core properties in 2012.

For our residential and serviced apartments, which are insignificant to our overall portfolio, the vacancy rate rose a little but total rents received went up.

PROSPECTS

In the coming year, I do not foresee changes to the current demand-curbing measures in Hong Kong. But after home supply sets in and prices fall somewhat, it is conceivable to have a policy reversal at that time.

So in the interim, we will continue to watch out for opportunities to sell completed apartments. Things will not move briskly but neither do we need to be overly bearish. Needless to say, we will do our best to the extent possible to maintain a relatively high profit margin. As I have written almost two years ago, we should not be too greedy.

In the recent past, we have witnessed respectable rental growth in Hong Kong. There is a reasonable chance that this will continue at least for this year.

On the Mainland, it is impossible to predict how long the anti-corruption/anti-opulence campaign will last. My personal hope is that it will stay long enough to turn the effects of the policies into a normal state of affairs. After all, Hang Lung is a long-term player willing to sacrifice short-term market gains for economic health in the long run. There is reasonable hope that such an outcome will materialize.

Before that day arrives, we will focus our efforts on improving operational efficiency. For that we need to do two things: enhance our operating system, and strengthen our management team including the rebuilding of an appropriate corporate culture.

In the past two to three years, much work has been done on the former. For example, we have installed a new Enterprise Resource Planning system that further integrates our Mainland offices with Hong Kong and with each other. Our internal audit, having been fortified, has also borne fruit.

The need for a bigger and stronger management team seems relentless. This is a condition usually associated with a small start-up firm and not a sizable company like ours with over half a century of history. The only other times that Hang Lung has seen such a fast pace of expansion was the decade immediately following our founding in 1960 and in the early 1980s when we took on over ten projects atop Hong Kong’s subway stations.

The explosive growth of the 1960s led to our going public in October 1972. By some measures, at that time we were perhaps the single largest Chinese-managed real estate company in Hong Kong. The only one bigger than us was Hongkong Land. The second expansion however ended in near disaster. After committing to many projects in a single basket, we ran into the political turmoil surrounding the Sino-British negotiations on Hong Kong’s return to her Motherland. The market fell precipitously and we were in serious financial difficulties. Fortunately we survived but it took us years to nurse ourselves back to health. This has taught us to be strategically cautious and financially prudent. Such lessons are still ingrained in our genes.

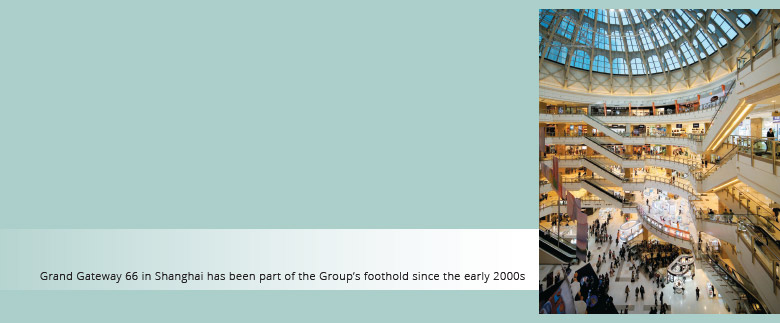

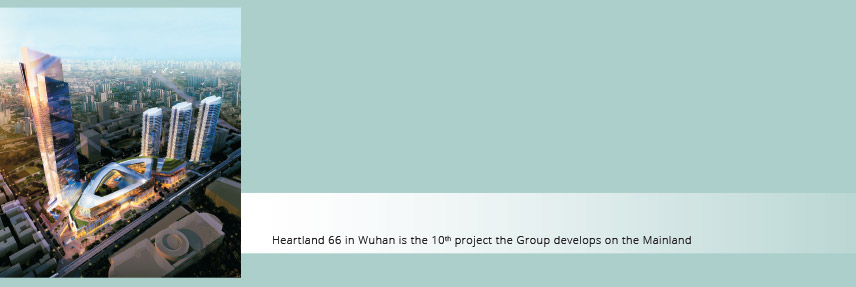

Now we are facing the third major expansion of the Company which relates to the Mainland. Strategically it was a long time in the making. We first spent about 12 years to experiment in Shanghai. Prior to jumping in, we carefully studied the market in 1991-1992, acquired two pieces of land in 1992 and 1993, built them out and opened the two malls – Grand Gateway 66 and Plaza 66 – in 1999 and 2000 respectively. Only after successfully running them for a few years and only upon further research did we venture into second tier cities. Starting from 2005, we bought several plots of land in carefully selected cities and opened the first mall outside of Shanghai, in Shenyang in 2010, 18 years after our initial entry into the Mainland.

The management necessary to execute the above is not inconsequential. Beginning in the second half of the 2000s, we beefed up our construction management capability. This was followed by the expansion of our leasing team. All along, we enhanced our corporate staff to support and monitor the enlarged team.

Inasmuch as a lot has already been accomplished, the humongous Chinese market with practically limitless opportunities kept beckoning. As shareholders know, we are extremely careful in accepting new projects, but once in a great while a particularly attractive one comes along and we buy. (In the nine years since 2005, we have only chosen eight sites in seven cities.) All that necessitates an expanded team. Much as we would like to stick to our tradition of being a lean organization – a few years ago, there was one year when each staff member produced some HK$10 million of after-tax profit – we also know that there can be a risk of being understaffed. Now that we have projects spread across the country, and given that a huge but transitional economy like China abounds with challenging ethical issues, risk management becomes paramount.

I am a firm believer that good systems and quality staff aforementioned alone are not sufficient. As I have previously written, we must build a corporate culture to supplement the system and the people. The genetics of management must be healthy.

Since the market will likely be lethargic in the foreseeable future, we will devote more time to perfecting these necessary elements. One thing we are certain: a bull market will sooner or later return. In good times, people, ourselves included, are busy exploiting opportunities. Those will not be auspicious times to strengthen systems and management. Now is the time to tune up the engine for better days ahead.

One way to characterize today’s situation is: we are in a cyclical downturn amidst a systemic upsurge. Urbanization and consumer spending are mega trends embedded in the rise of China which in itself is a mega trend of the world. We are extraordinarily well positioned to ride that long-term wave.

I am confident that the third expansion of Hang Lung will lead to a golden era that the Company has not seen before. Enough signs are there to give us due confidence. Consider this: when all the Mainland projects are completed and if they only perform half as well as our two in Shanghai, the result in terms of both total rents received and return on investment will be impressive indeed.